AD Code registration

An Authorized Dealer (AD) Code is a mandatory requirement for businesses involved in exporting goods from India. Issued by banks authorized by the Reserve Bank of India (RBI), the AD Code must be registered with the Customs Department to enable the generation of shipping bills and facilitate smooth export transactions. At My Physio, we offer comprehensive AD Code Registration services to help exporters comply with customs regulations and avoid shipment delays.

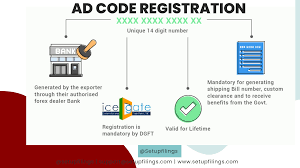

What is an AD Code?

An AD Code is a 14-digit numerical code provided by an exporter’s bank. It links the exporter’s bank account to the Directorate General of Foreign Trade (DGFT) and Indian Customs. Without an AD Code registered at the port of export, exporters cannot generate shipping bills — a key requirement for customs clearance.

Why AD Code Registration is Important

-

Mandatory for Export Clearance: Shipping bills cannot be processed without an AD Code.

-

Enables Government Benefits: Ensures access to export incentives and duty drawback schemes.

-

Tracks Export Transactions: Facilitates reporting and tracking of foreign exchange earnings.

-

Customs Compliance: Ensures that exports are routed through legal banking and customs channels.

Our AD Code Registration Services Include:

-

Guidance on required documentation and eligibility

-

Liaison with your Authorized Dealer bank

-

Preparation and submission of the AD Code letter

-

Registration of the AD Code with relevant port customs

-

Coordination with ICEGATE and EDI systems

-

Support for multi-port registration, if needed

Required Documents for AD Code Registration:

-

Copy of Import Export Code (IEC)

-

PAN card of the business

-

Bank certificate or letter with the AD Code on bank letterhead

-

GST registration certificate (if applicable)

-

Business address proof

-

Authorization letter (if filed through a representative)

How We Simplify the Process:

-

Initial Consultation: Understand your export activity and target ports.

-

Document Collection: We assist in preparing and verifying necessary documents.

-

Bank Coordination: Liaise with your bank to obtain the AD Code certificate.

-

Customs Registration: Register your AD Code with customs at the required port(s).

-

Ongoing Support: Available for updates, amendments, or port additions as your business grows.

Why Choose Us?

-

In-depth knowledge of customs and banking procedures

-

Quick turnaround with complete documentation support

-

Experience across major Indian ports and EDI systems

-

Transparent pricing and end-to-end service

Get Started

Ensure a hassle-free export process with our expert AD Code registration services. Reach out today to speak with our compliance specialists and start your registration without delays.